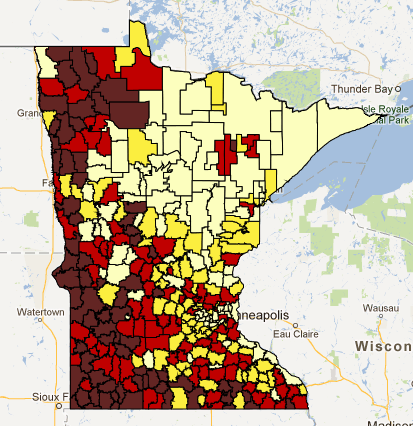

MREA released a map today showing the tax relief and equalization in HF 630. A thumbnail is below. View the interactive map.

HF 630 replaces $28 million in Operating Referendum Levies with State Equalization dollars:

- Creates Referendum Market Value Equalization Factor (RMVEF)

- RMVEF will float with state total RMV value and state total PU’s so it maintains somewhat close to current tax effort adjusting for changes in property value and student population

- RMVEF estimated to be $431,150.

- Raises Tier 1 Equalization Factor to 122% of RMVEF. That’s an 11% increase from the from current $476,000.

- Raises Tier 2 Equalization Factor to 66% of RMVEF. That’s a 5% increase from the current $270,000.

HF 630 Tax Impact on Homeowners

- Provides homeowners in the 249 school districts with voter approved operating referendums tax relief which also have less than $526,000 in RMV/PU.

- Provides the greatest tax relief up to $39.75 for $150,000 homes in districts with less than $270,000 in RMV/PU with referendums of $700 or more

- Provides 50% of that relief ($21.00 for $150,000 homes) for homes in school districts with more than $270,000 in RMV/PU with referendums of $700 or more