Ensuring Minnesota students have highly qualified teachers across all grade levels and specialties includes maintaining a stable, defined-benefit retirement plan with shared responsibility of the state, school districts, teachers and retirees.

Studies show that defined benefit pensions help attract and retain teachers.

- Recruitment: Among younger workers under age 40, nearly 2 out of 3 workers say a defined benefit (DB) pension is important in accepting the job. That’s up from one out of four workers just two years before. (Towers Watson, 2012)

- Retention: Three out of four new hires say DB pension is a compelling reason to stay on the job. Studies show teacher effectiveness and productivity improve with experience. (Towers Watson, 2012 and National Bureau of Economic Research, 2006; Milanowski and Odden, 2007)

Time to Stabilize

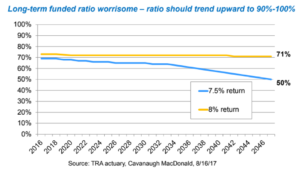

No action this legislative session would call the viability of the fund into question, as it continues a downward slide to the 50 percent range within 30 years. The fund should be funded at 90-100 percent of liabilities.

No action this legislative session would call the viability of the fund into question, as it continues a downward slide to the 50 percent range within 30 years. The fund should be funded at 90-100 percent of liabilities.

The sources of the TRA Funded Ratio problem are two-fold:

- Long-term expected investment returns are lower.

The TRA Board has lowered expected returns from 8.5 percent to 7.5 percent, which decreases the expected investment returns by 12 percent. - Longevity of teachers increases needs.

Members and retirees are living on average an extra two years, adding to TRA predicted obligations.

Cost of Delay

Delaying a solution costs an estimated minimum of $40 million per year.

- No contribution increases ($10 million – $22 million annually) = foregone Revenue

- Pay higher COLAs = lost cost savings ($18 million per year on cash flow basis)

- Investment gains are lost on foregone revenue and cost savings.

Delaying a solution will begin to affect school districts’ bond rating, because GASB requires that the TRA underfunded liability be listed on school districts’ balance sheets.

A Solution

A preferred solution is the 2017 Schoen Amendment to SF 545. This plan would reduce the COLA for five years, yielding a 40 percent savings.

MREA and other education organization support this plan as long as the employer contribution is made whole to school districts by the state through the use of the pension adjustment line in UFARS.

TRA estimates that enacting the Schoen amendment would restore TRA to 95 percent of funded liability by 2047.

The Legislative Commission on Pensions and Retirement (LCPR) is the Senate and House joint committee that is responsible for TRA and other state pension plans. It is composed of seven senators and seven representatives appointed for the biennium.

The Chair is Sen. Julie Rosen and the Vice Chair is Rep. Tim O’ Driscoll. Both represent parts of Greater Minnesota and MREA member districts. View the 14 members of LCPR

For more on the benefits of TRA, the longer term problem and actions taken and not taken in the 2017 legislative session, see Addressing Pension Underfunding by John Wicklund, TRA Chief Financial Officer, presented at the MREA 2017 Annual Conference.