By Vernae Hasbargen, MREA Lobbyist

As the K-12 bills head to the floor, it is now clear where the similarities and differences are and for school districts, a tough choice – do you want dollars now or stability in the state’s funding system later?

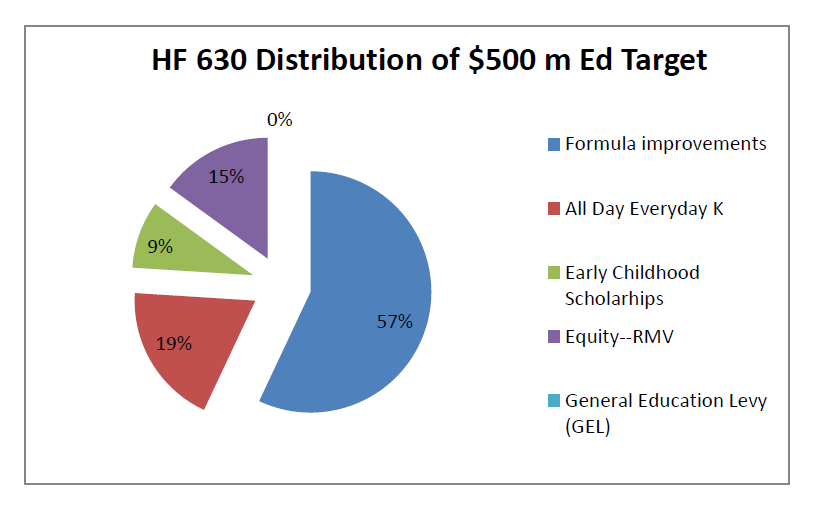

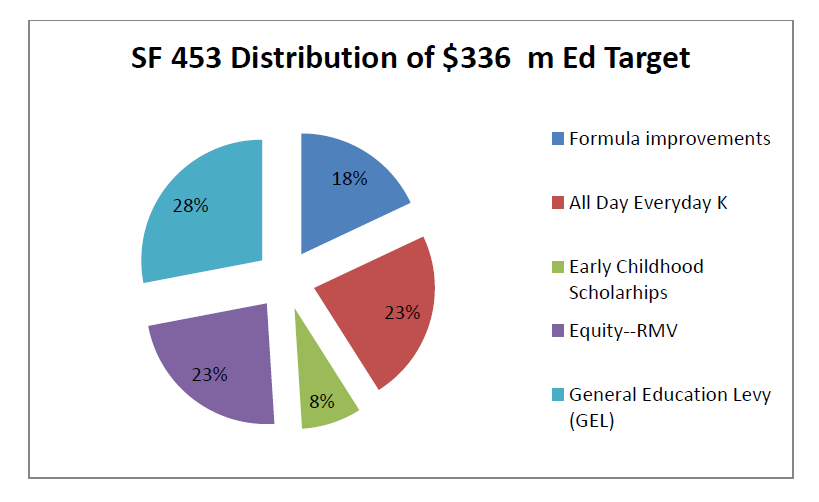

As you can see from the graphs, both bills reflect similar spending priorities when it comes to ADK and early childhood scholarships. But the House wants much more sent to classrooms in a formula increase, while the Senate focuses on re-instituting a General Education Levy.

Priorities in K-12 Bills

House Senate

Formula 57% 18%

ADK 19% 23%

Early 9% 8%

Equity 15% 23%

GEL 0% 28%

Why a General Ed Levy?

Senator Stumpf, along with K-12 Chair Chuck Wiger, is determined to reinstate the GEL because as Stumpf put it, repealing the Minnesota Miracle in 2001, without replacing the lost property tax with sales tax, set up a pattern of rolling deficits for the state and growing disparity for students.

Stumpf referenced recommendations from two task forces, one under Governor Pawlenty and another under Governor Dayton, that called for restoring the GEL because the rolling deficits have left a formula that is less today than in 2003 when adjusted for inflation.

More importantly, the growth of operating levies to make up the difference has, as Tax Chairman Rod Skoe put it, “created a different subset of people paying for schools” and that gets at the heart of the political opposition to the idea.

Who’s Paying?

The proposed GEL is levied on Net Tax Capacity that includes ag land, businesses, and seasonal recreational property as well as homes. Two of the three levies Stumpf uses to create the new GEL (operating capital and safe schools) are levied on NTC.

The proposed GEL is levied on Net Tax Capacity that includes ag land, businesses, and seasonal recreational property as well as homes. Two of the three levies Stumpf uses to create the new GEL (operating capital and safe schools) are levied on NTC.

The third levy the Senate uses to create a new statewide funding mechanism is the equity levy which is based on Referendum Market Value. So are referendums, which have nearly quadrupled since the 2001 takeover.

The RMV tax base includes only homes and leaves out ag land, businesses, and seasonal recreational taxpayers. As a result, those increasingly paying for school are local homeowners, while business and cabin property taxes go to a statewide base and into the state’s general fund.

Now Tough Choice for Districts

The graphs point out what will be a tough choice. Will districts want dollars on the formula today or the guarantee of a state funding system that won’t be subject to rolling deficits and unstable funding in the future?

The Senate faces stiff opposition from the Chamber and Business Partnership about adding a new GEL on top of the statewide property tax they pay. But the business community is also unhappy about two policy changes enacted into law under Republican leadership – postponing implementation of the teacher evaluation law and eliminating the Basic Skills Test required for students to graduate.

The Senate has some cover since the House strongly supports eliminating the GRAD test, but is moving ahead with implementing teacher evaluation in 2015.

Fred Nolan, MREA’s Executive Director and a former superintendent, has pointed out that this year’s sophomores face a crisis when the current waiver expires and they are subject to the high stakes of passing the test in order to get a diploma. Nolan believes changes are necessary and that it is going to take courage for lawmakers because Minnesota won’t be #1 in the ACT anymore when 100 percent of the students take it.

K-12 Chair Paul Marquart has his own plan for making school districts accountable for results. He would impose a 4 percent penalty on districts that don’t increase their graduation rate and if they stall for three years, face the intervention of Regional Centers of Excellence that will work with them on a turnaround strategy.

“No cut scores, no scarlet letters, if districts don’t make it”, Marquart said, “Just a strategy that’s worked in every case so far.”