By Vernae Hasbargen, MREA Lobbyist

As the House K-12 bill cleared the floor, its youngest representative, Joe Radinovich, commented, “After a decade of disinvestment, this bill will not solve everything, but it is a step in the right direction.”

Radinovich was an 8th grader in Crosby-Ironton when his district faced its first round of budget cuts, and in the decade that followed, he said it was “most disheartening” to experience continued program cuts and loss of student opportunities.

As the final K-12 bills head to conference committee, the right direction Radinovich describes is the giant step they take toward funding fairness, especially for students in Greater Minnesota.

Gap Closes

Radinovich was the author in the House and Senator Skoe in the Senate of the most dramatic part of the bills, Education Advancement Revenue (EAR). EAR allows a school board to convert $300 of referendum into permanent funding, while districts without referendum, will receive $300 from a combination of state aid and local levy.

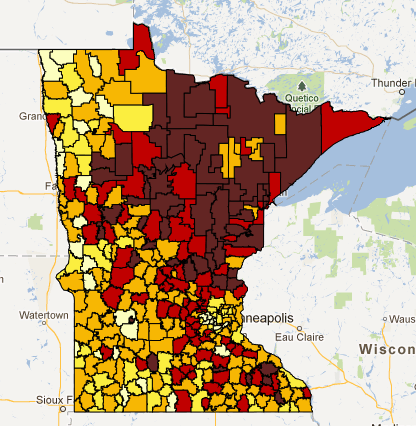

EAR brings students at the bottom up by $300 and closes a funding gap that has increased so dramatically when referendums became a survival mechanism. “Some can levy their way out and some can’t,” Radinovich told his House colleagues, “Minnesota cannot afford to walk two paths when it comes to education.” View a map showing where voters have approved referendums across the state and learn more.

MREA’s map points out where the students live who have not had the property wealth in their districts to pass a referendum, most likely because the 2001 tax reform eliminated cabins and business property from the tax base (RMV), leaving lower income homeowners to pay the price.

Statewide Education Levy Possible

Senator Stumpf, the most senior member of the Senate, is determined to go back to a General Education Levy (GEL) like the Minnesota Miracle that was also eliminated in 2001. But the House does not have this provision in its bill. This will be one of the most important areas of compromise as the House and Senate bills are conferenced.

Stumpf’s new GEL comes in the wake of property tax relief created by having the state buyback $170 million from three existing levies. Two of the existing levies, Operating Capital and Safe Schools, are levied on ANTC. The third, Equity, is levied on Referendum Market Value.

The new GEL requires the Commissioner of Revenue to establish a uniform rate on ANTC in each school district sufficient to generate $20 million statewide in FY 15. The GEL would grow to $26 million and $30 million in respectively in FY16&17.

Stumpf credits a recent Task Force on funding headed by Tom Melcher for proposing the return to a GEL because of tax base differences between districts so great, on average 4:1, that taxpayers in some districts can pay 4 times as much to raise the same amount of money as those in other districts.

MREA research shows that taxpayers across the state pay anywhere from $76 to $1045 per year on a $150,000 home for education depending on the district in which you live. Many legislators are quick to point out that a zip code shouldn’t determine a student’s educational opportunity or in this case, make such a profound difference in how much a taxpayer pays.

Levies To Be More Fair

Finally, both bills include greater equalization of referendum levies, creating tax relief for taxpayers primarily in the most lightly colored areas of the map. All in all, the Senate spends more than seven times as much as the House to reduce property taxes and that imbalance will be a key in negotiations.

Regardless of the final outcome, MREA members can agree with Radinovich that this year’s new law will definitely be “a step in the right direction.”