About 83 percent of Minnesota public school operating revenue comes in the form of state aid. New legislative policy proposals that would deplete state revenues led MREA to take a closer look at property taxes and the impact of E-12 education funding in Minnesota.

The Senate omnibus tax bill (SF 5) currently being debated would reduce state general fund revenue by further reducing the state business property tax by $47.5 million annually.

MREA looked to Jeff Van Wychen, a tax analyst, to dig into the data and provide a thorough analysis of Minnesota’s business property taxes, including the state business property tax.

What’s Happening?

Here’s a look at the numbers and key trends:

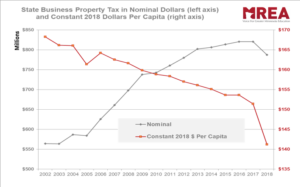

- While the state business property tax has increased in nominal dollars from 2002 to 2018, in real dollars (i.e., inflation-adjusted) per capita it has declined by 16 percent.

- The state business levy—even with the inflation adjustment (repealed in 2017 when the tax was frozen)—has partially insulated businesses from nearly all of the forces that have been pushing local property taxes upward, including population growth, increases in the number of special need students, the growing special education cross-subsidy, and real per capita and per pupil cuts in state aid to local governments.

- The state business property tax is one of the major reasons why commercial/industrial property taxes in Minnesota have increased far less rapidly than property taxes of residential and most other classes of property.

- Currently, the state business property tax is the only Minnesota major state tax that is completely frozen, with no adjustment for inflation, population growth, the aging of the state population, or any of the other factors that push public costs upward. When one revenue source is frozen, increasing public costs are shifted onto other sources and other taxpayers.

Real per pupil state aid to Minnesota public schools in FY 2019 is already 7.8 percent below the FY 2003 level, according to data from the Minnesota Department of Education. Further reductions to the state business property tax—on top of those enacted two years ago—will further jeopardize school finances.