MREA Compares Compensatory Revenue Pre and Post COVID Pandemic

Compensatory Revenue has been a hot topic during the 2023 legislative session. Further, the legislature and the governor are pushing for Universal Meals for students, found in HF5. Under this legislation, all students would be eligible for free breakfast and lunch each day, regardless of their family’s income. There is significant momentum behind this bill, and it is likely to pass. To ensure the basic needs of all students, the Governor and legislature are in favor of Universal Meals. They also believe that direct certification helped increase compensatory revenue for school districts.

Last year was the first year of direct certification, where students whose families were Medicaid eligible were automatically entered into a districts database. There was excitement about how this change could affect compensatory revenue for districts. Many districts were seeing big jumps in their FY24 compensatory numbers.

Under Universal Meals, where all students eat free, parents would have little incentive to fill out the free and reduced paperwork that generates compensatory revenue. There had been speculation that districts would capture around 90% of free and reduced eligible kids through Direct Certification, but district runs show that districts only capture about 61% of reduced students and 86% of free students. See Direct Certification Numbers for Fall 2022. The result is that many districts will still need to collect free and reduced paperwork to gain additional compensatory dollars.

MREA dug into Compensatory Revenue pre-pandemic versus post-pandemic. Compensatory numbers are based on free and reduced student populations from the previous year.

In MREA’s map, we consider FY21 “Pre-Pandemic” compensatory revenue. These numbers are based on FY20 free and reduced counts, which were generated in the fall of 2019.

MREA considers FY24 “Post-Pandemic” compensatory revenue. These numbers are based on FY23 free and reduced counts, which were generated in the fall of 2022.

It’s important to note that if there is an increase in the general formula as a result of the 2023 legislative session, it will positively affect all district’s compensatory revenue, making the FY24 estimated numbers low.

MREA’s map compares per pupil Compensatory funding in FY21 and FY24, considering potential pupil loss because of the pandemic and having the benefit of direct certification.

The results were dramatic, showing that almost every district in the state gained compensatory revenue per pupil from FY21 vs FY24. Only six districts in the state (Campbell-Tintah, Ellsworth, Ivanhoe, Cromwell-Wright, Cass Lake, and Ada-Borup (newly consolidated)) received less compensatory revenue in FY24. The median increase is $249/pupil, while Houston Public School District increased the most at $1,370/pupil.

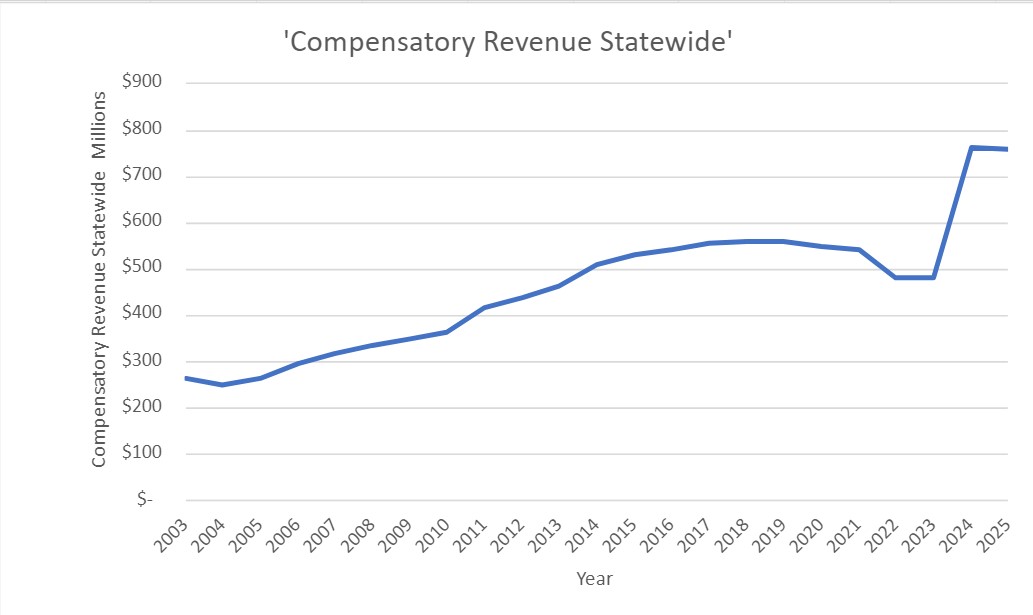

According to MDE financial trends data, over the last 20 years the total dollars in revenue the state allocates for compensatory has increased at a steady pace. However, the jump from FY23 to FY 24 was the most dramatic increase in the last two decades. MREA also received data runs from House Research that show compensatory numbers for FY23, FY24, and FY25. Although many districts lost pupils during this period, most districts saw a significant increase in compensatory revenue from FY23 to FY24.

This data infers that direct certification was an important factor. There are still students who will be eligible for free and reduced meals that the district will not capture, even with direct certification in place. This is a challenge in any legislation that includes Universal Meals.

One bill, SF2017, offers a potential partial solution, giving districts the opportunity to recover up to 10% more compensatory revenue. According to the data run, this would still likely leave districts short on compensatory revenue if there were no more free and reduced forms filled out.

The Governor and his staff are working on a solution to ensure districts don’t lose compensatory revenue if the Universal Meals legislation passes.

On March 16, 2023, the Governor released a revised budget proposal that has a potential compensatory revenue fix. It holds districts harmless at FY24 levels, which include the direct certification student counts. There is money included in future years to keep the compensatory at this base level. They are also talking about transitioning to a new formula, which should help with those students who are not captured in direct certification but are still eligible for free and reduced.

As of Friday, March 17, 2023, legislators are still proposing that 80% of compensatory revenue goes to the site where the free and reduced students are located and the remaining 20% to the district. MDE believes this will fix compensatory at a state level, but districts will still need to have free and reduced forms filled out for federal meals reimbursement dollars.

Careful consideration needs to be taken when considering ways to eliminate free and reduced forms, because there are other revenue streams tied to these forms.

MREA is in direct conversations with the Governor, his staff, and key legislators and carefully following legislation to help ensure districts do not lose revenue with potential changes in compensatory funding.