Financial Impact of Mandates

Many thanks to the 150 district officials who responded to a survey request put forth by the various education organizations. After combing through the responses, we boiled down aggregate data and averages based on 120 of the district responses, which represented over 390,000 students.

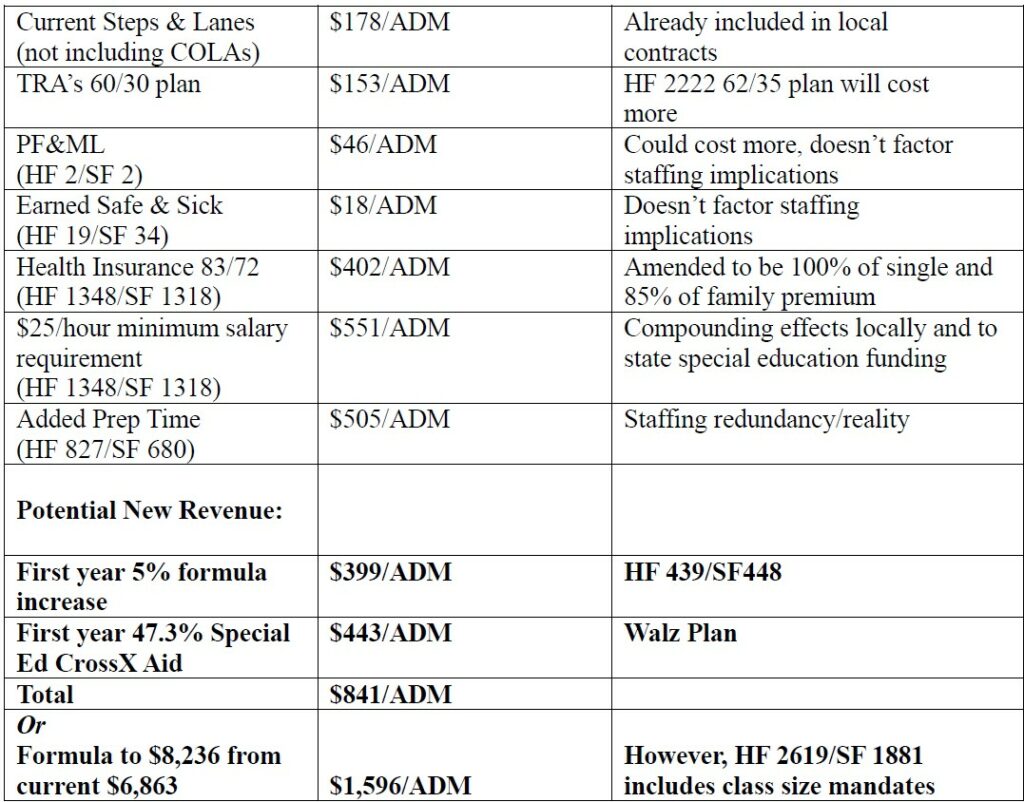

Summarizing the survey of school employee economic mandates:

- • Over 120 districts responded covering more than 390,000 students (survey responses still coming in).

• Survey results are for fiscal year 2024 only and represent a brief snapshot, not looking at future budget impacts of these mandates, both locally and for the state.

• The survey results are certainly low as responses are based on 83/72 for health insurance, which was subsequently amended to be 100/85. Plan selection is a major variable and cost trend is increasing.

• The survey questions don’t cover proposed class size mandates or requirements to bargain staffing ratios, nor labor market realities, community impact, and district staffing challenges due to PFML, ESS and Unemployment mandates.

The survey has many caveats, most notably that it’s a one-year snapshot and the legislature is accustomed to budgeting on a biennial basis. The survey is also undercounted as the health insurance question was based on the legislation as initially introduced, which would have required 83% employer paid premium for single and 72% for family. The bill was subsequently amended to be 100/85 respectively.

As the omnibus education budget bills roll out this week, we’ll see if any of the big ticket economic mandates are moving forward. The biggest cost items, outside the norm of current bargaining and contracts are the health insurance mandates, additional prep time and a support staff minimum wage starting at $25/hour. The TRA ‘60/30’ would pull $153 million each year out of the budget target to cover the employer’s cost, not to mention another $51 million that employees would contribute.

The survey wasn’t intended to simply say “no” to increasing economic benefits to school employees. Everyone seems to agree that staff compensation needs to increase.

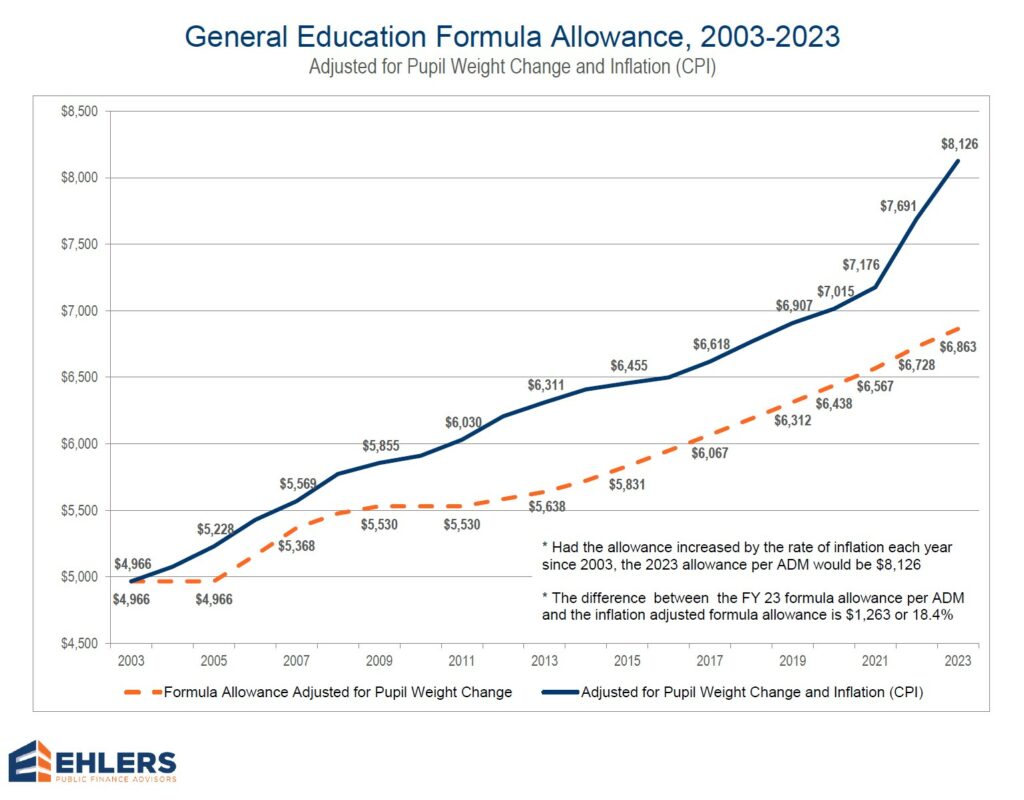

We’ve all seen the above line graph, showing a two-decade trend of underfunding the basic formula, not to mention the feds and state falling behind as special education costs have risen. The issue is trying to reverse the trend in one fell swoop. It just isn’t doable, even with the massive budget surplus available to the state. K-12 is slated to receive the most of any one budget area, especially when the tails budget is factored into the equation.

Let’s advocate for the restoration of public school economics, a leveling up of school budgets, and a respect for local bargaining to sort out the dollars and initiatives locally. We should be able to look back at the 2023 session as the turning point for public education funding in Minnesota.