MREA released a new map today showing the impact of proposed legislation on voter approved operating levies for Minnesota’s E-12 schools.

Senate E-12 Chairman Roger Chamberlain (GOP-Lino Lakes) has an interest in equalizing the property taxpayer effort for voter approved operating referendum, especially in deeper rural school districts.

Currently, most school districts in Greater Minnesota don’t have voter approved levy authority as most school boards have transitioned voter approved authority over to the Local Option Revenue (LOR) levy. LOR levy authority is capped and if the state is unable to finance new formula dollars or backfill the loss of pupil revenues and compensatory due to COVID-19 impacts, then going to the voters may become necessary in the short run.

SF 626 seeks to change that by spreading $25 million across the state to reduce the current $809 million in voter approved levy authority.

SF 626 seeks to change that by spreading $25 million across the state to reduce the current $809 million in voter approved levy authority.

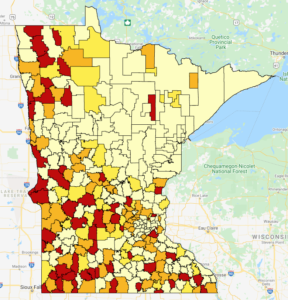

View the interactive map to see the impact on your school district and region. Those highlighted in red would see the greatest change while districts in the lightest yellow would not be impacted.

How It Works

Moving away from the traditional model for calculating equalization — a property wealth per pupil model — SF 626 drives state property tax equalization based on a fixed percent of local property taxpayer effort compared to the local market value.

Wonky and complicated, yes, but smaller and medium rural communities would see the largest amount of assistance under the new approach outlined in this bill.

For rural districts with no voter approved authority, the new equalization program outlined in SF 626 could be very beneficial should they need to approach voters for additional operating dollars.

Improving equalization for operating levies is a core need for Minnesota’s E-12 schools. View the interactive map to see the impact of the SF 626 ($25M as calculated by A1 amendment .04 and .09 factors).