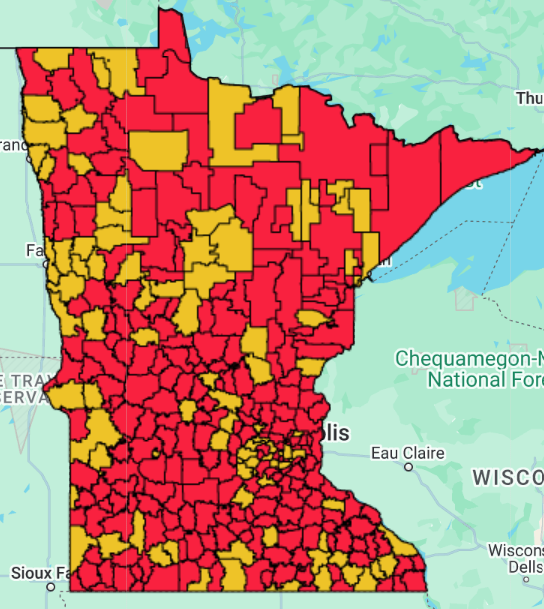

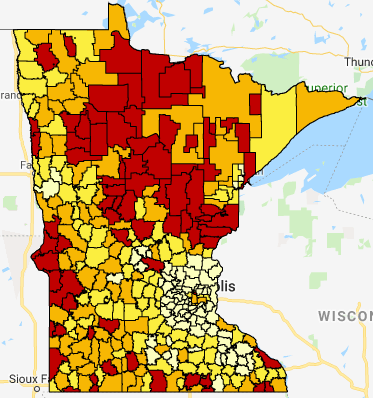

What does Compensatory Revenue look like under the Governor’s January 2025 proposal? How much would each school district receive in Compensatory Revenue?

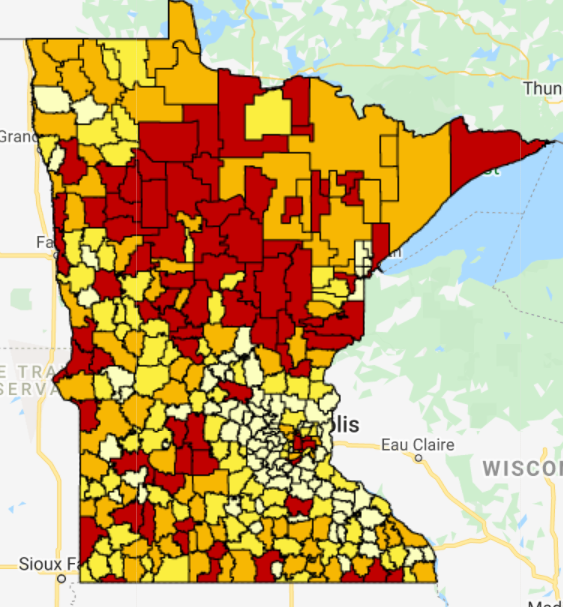

What does Compensatory Revenue look like under the current law with direct certification? How much will each school district receive in Compensatory Revenue?

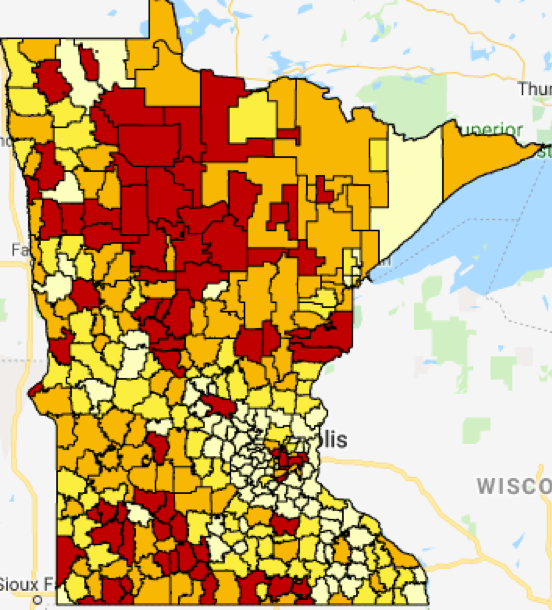

With the 70% percent credit for Ag2School, what does funding look like for Minnesota districts?

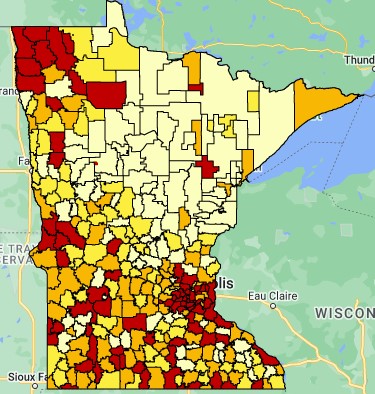

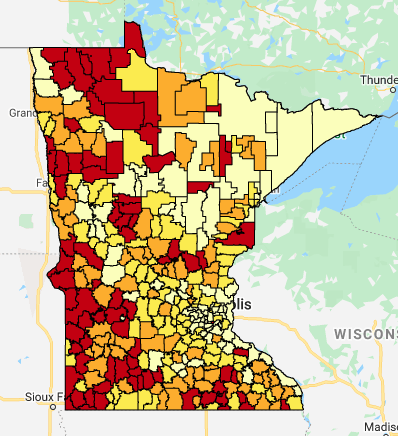

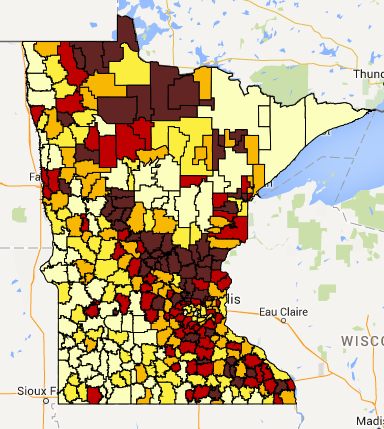

Patterns in Referendum Market Value by Residential Pupil Units as a measure of Minnesota school district property wealth in 2025.

How has school operating revenue changed statewide? What’s the impact per Adjusted Pupil Unit?

How much did each school district receive in ESSER funds? What is the per pupil amount? What can districts spend their funds on? How is the amount determined?

How has school operating revenue changed statewide? What’s the impact of Local Optional Revenue and Board Authorized Referendum Revenue?

Patterns in Referendum Market Value by Residential Pupil Units as a measure of Minnesota school district property wealth in 2021.

There’s a wide rural-metro divide with the state’s wealthiest district’s median income more than five times the amount of the poorest district.

Family income and child poverty in Minnesota’s school districts by means of free and reduced lunch meals. Fifteen Greater Minnesota school districts have FRE percentages of 67 percent or more.

Patterns in ANTC/APU as a measure of Minnesota school district property wealth in 2017.

The Senate and House both have bills that will provide reduction aid for 100 percent…

In past legislative sessions, MREA has noticed many rural legislators are hesitant to put money…