Special Education and EL Cross Subsidy MREA hears a lot about how the Special Education…

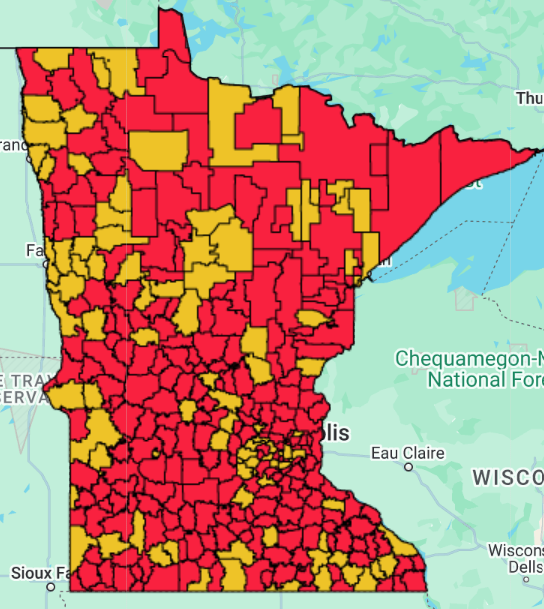

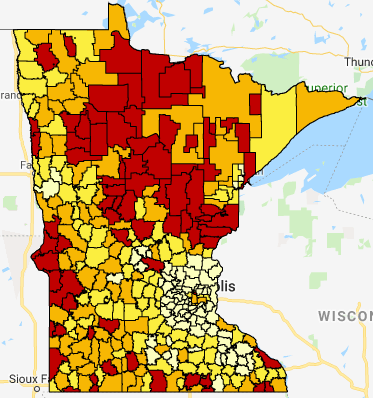

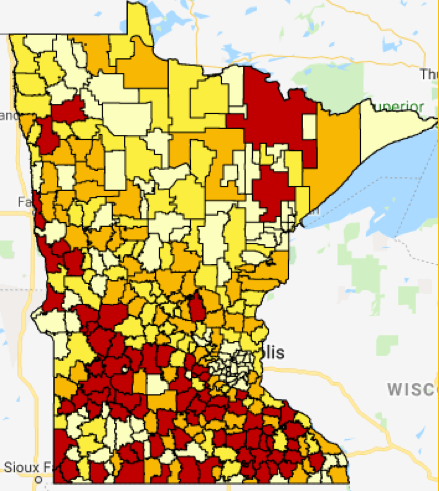

What does Compensatory Revenue look like under the Governor’s January 2025 proposal? How much would each school district receive in Compensatory Revenue?

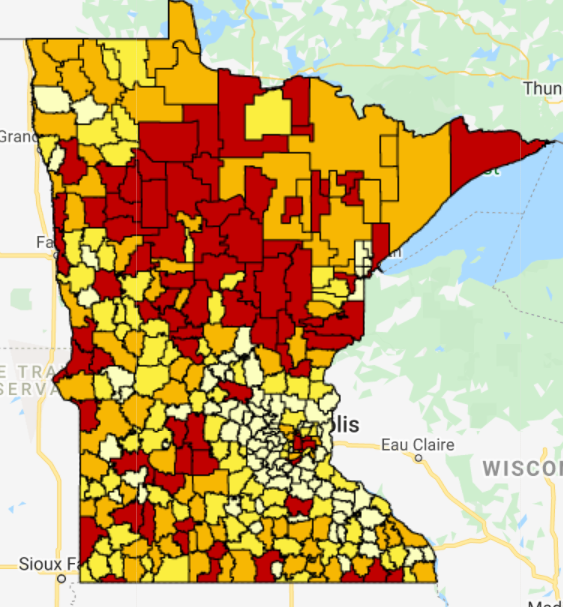

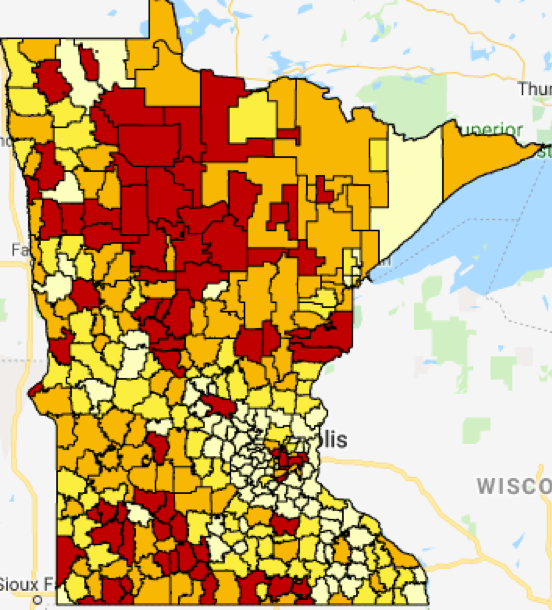

What does Compensatory Revenue look like under the current law with direct certification? How much will each school district receive in Compensatory Revenue?

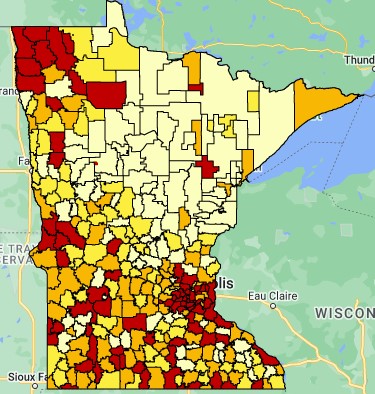

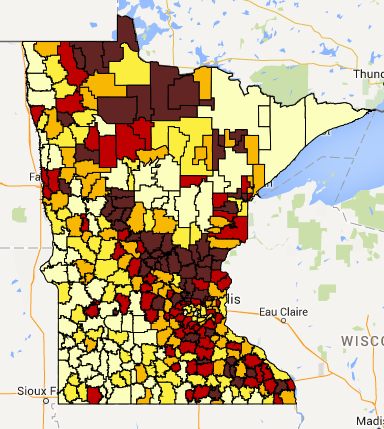

With the 70% percent credit for Ag2School, what does funding look like for Minnesota districts?

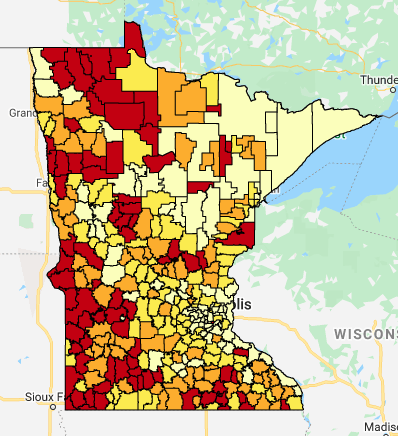

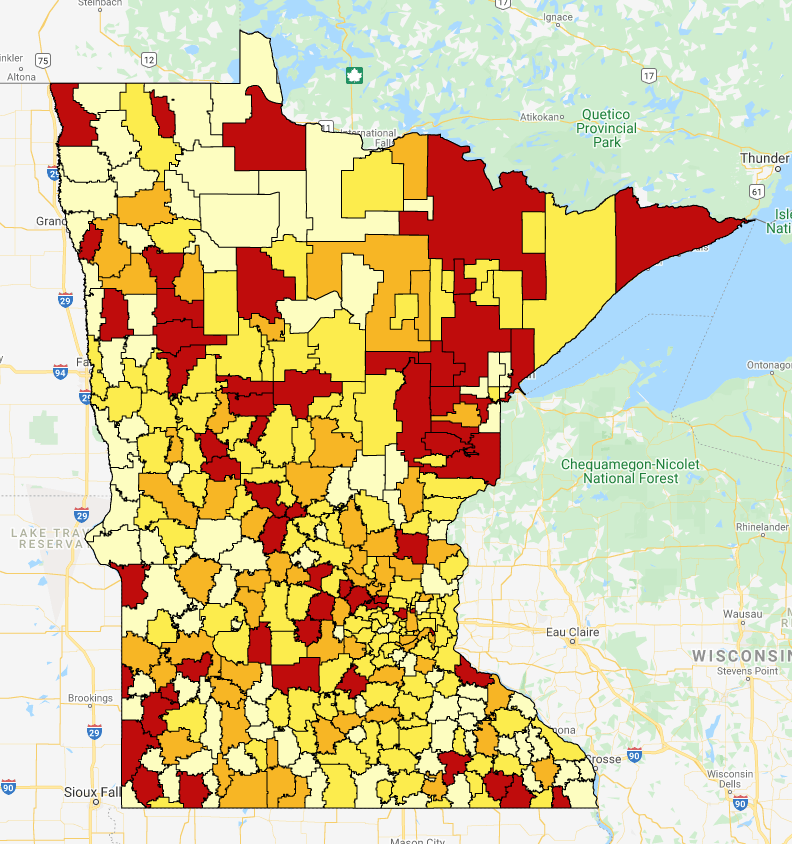

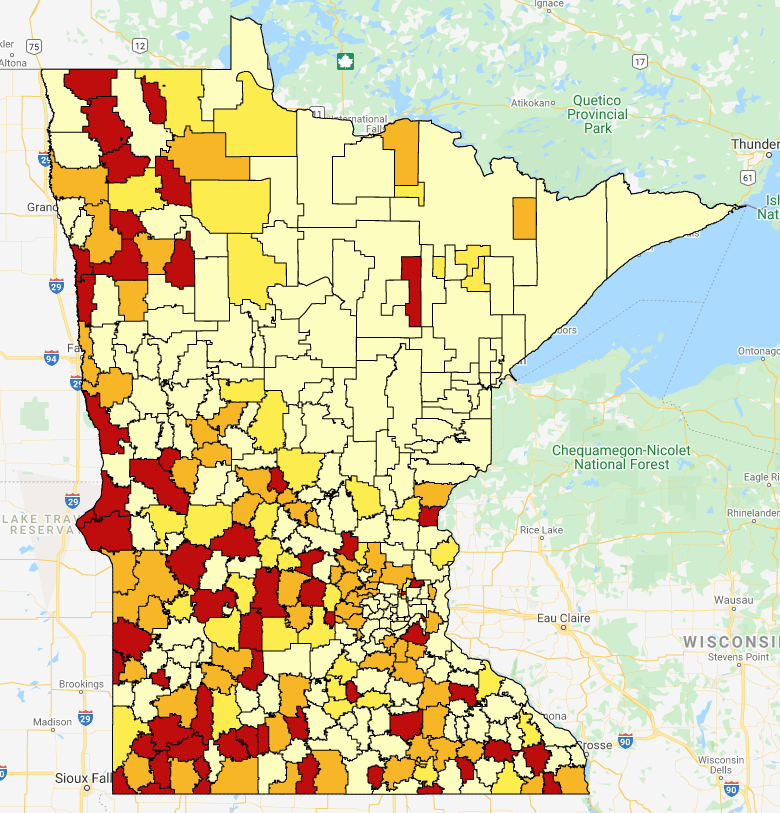

Patterns in Referendum Market Value by Residential Pupil Units as a measure of Minnesota school district property wealth in 2025.

How has school operating revenue changed statewide? What’s the impact per Adjusted Pupil Unit?

How much did each school district receive in ESSER funds? What is the per pupil amount? What can districts spend their funds on? How is the amount determined?

How has school operating revenue changed statewide? What’s the impact of Local Optional Revenue and Board Authorized Referendum Revenue?

Patterns in Referendum Market Value by Residential Pupil Units as a measure of Minnesota school district property wealth in 2021.

There’s a wide rural-metro divide with the state’s wealthiest district’s median income more than five times the amount of the poorest district.

Family income and child poverty in Minnesota’s school districts by means of free and reduced lunch meals. Fifteen Greater Minnesota school districts have FRE percentages of 67 percent or more.

Patterns in ANTC/APU as a measure of Minnesota school district property wealth in 2017.

Special Education and EL Cross Subsidy MREA hears a lot about how the Special Education…

Basic Skills Revenue (Compensatory) is used to meet the educational needs of pupils who are…

MREA Releases ESSER Funds Map and Answers ESSER Questions The federal government recently announced the…

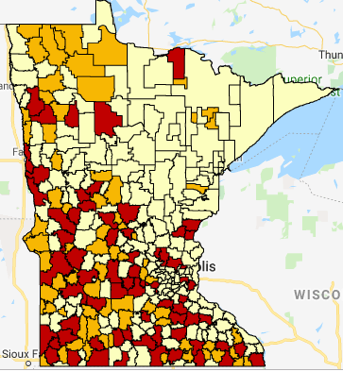

MREA released a map today showing the impact of the proposed one-time financial relief for…

MREA released a new map today showing the impact of proposed legislation on voter approved…

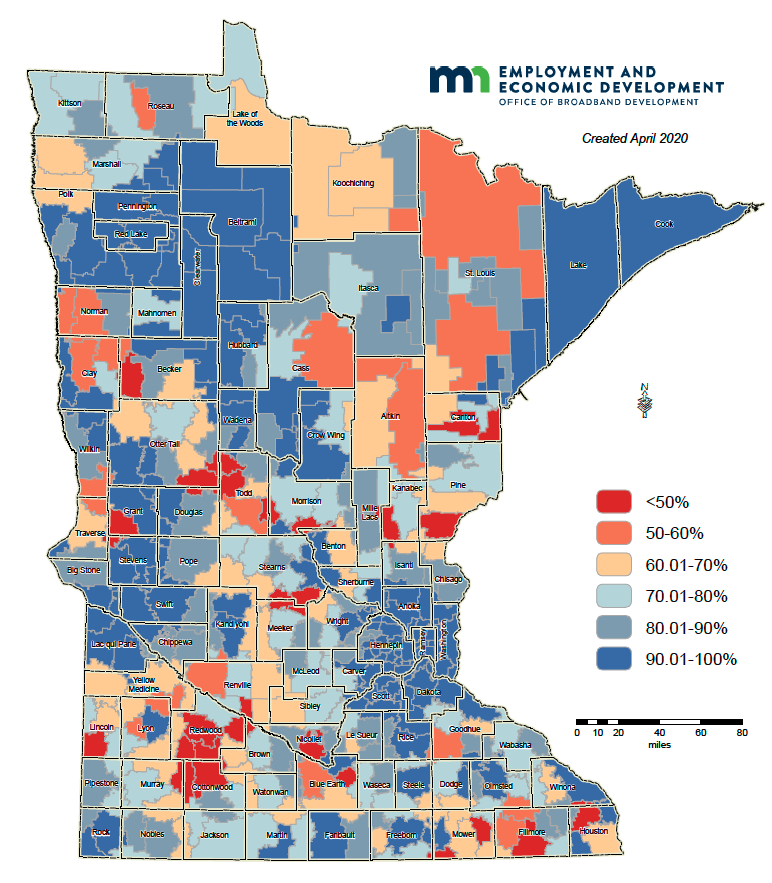

Nearly 31,000 rural public school students live in households that do not have broadband Internet…

A new map with the latest from Minnesota’s Office of Broadband Development shows rural households…

A new report on Compensatory Revenue from the Office of Legislative Auditor provided a series…

Bond referendums in rural Minnesota have passed at a higher rate, following the state increasing…

An increase in the First Tier of operating referendum equalization in Minnesota in 2019 will…