The equalization of Local Optional Revenue (LOR) has left out some of the poorest school districts in the state. The property wealth of school districts in the Central Lakes and Northeast Minnesota regions are among the highest in the state, and yet they have almost no relation to median income or Free and Reduced Lunch percentages.

The 23 school districts with more than one-third of their net tax capacity in Seasonal Rec property are 61% above the state average in net tax capacity and 16% below state average median household income. View printer-friendly brief on this issue.

Where We Stand

Seasonal recreation property has been excluded from Referendum Market Value (RMV) since 2001 while similar lake homes occupied year-round are included. These year-round occupied homes artificially inflate the RMV/RPU of the school district.

Seasonal recreation property has been excluded from Referendum Market Value (RMV) since 2001 while similar lake homes occupied year-round are included. These year-round occupied homes artificially inflate the RMV/RPU of the school district.

In 2014 MREA did a thorough analysis of the seasonal rec statewide tax, the impact of the 2001 legislative decision to remove seasonal recreation properties from RMV and the predicted effects of reversing that decision.

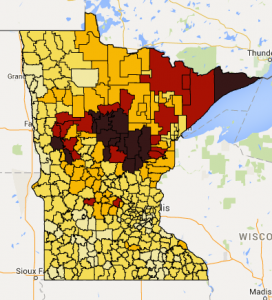

The map to the right outlines the impact of season recreational properties as a percentage of the total market value of a Minnesota school district. View the interactive map.

What’s Next

The results of the analysis led MREA lakes area member districts to decide not to pursue a reversal of the 2001 action. Key results include:

- Homeowners in these districts currently pay less property tax on similarly valued houses than seasonal rec properties.

- Homeowner RMV tax efforts are similar between lakes area and non-lakes area districts.

- Both homestead and seasonal rec property taxes would likely decline.

- The largest declines in dollar amounts and percentages would go to the higher valued seasonal rec properties.

- The statewide seasonal rec tax raises $44 million per year.

Key Considerations

- Is enhanced equalization the preferred strategy for 2016 to address this inequity?

- Is the target of 30 percent of greater seasonal rec the most appropriate?

- Should Minnesota consider a more general solution to this problem or continue to address it with property type specific solutions?