A new report on Compensatory Revenue from the Office of Legislative Auditor provided a series of legislative recommendations to respond to gaps.

“Schools use compensatory education revenue for a wide range of educational programs that serve underperforming students, but the extent to which the revenue has an impact around the state on student achievement is unknown,” the report said.

Jody Hauer, project manager, in testimony before the House Education Finance Committee described compensatory revenue as a “vital source of revenue for schools,” and the administrators she interviewed are, “Hoping to help the kids [with these funds]. The report states that since compensatory funds are used with other funds, it is “difficult to determine whether results are tied to compensatory revenue alone.”

The report makes several recommendations to the Legislature:

- Repeal the statute requiring school districts to report on whether compensatory revenue raised student achievement. (p. 48)

- Require school districts to report whether programs paid with significant amounts of compensatory revenue are consistent with best practices, and MDE should identify future best practices. (p. 63)

- Consider changing the calculation of compensatory revenue to lessen the downsides of using prior year counts of qualifying students. MDE should evaluate additional methods for obtaining counts of these students. (pp. 30, 26)

- Repeal the statute requiring school districts to reserve a share of compensatory education revenue solely for extended time programs. (p. 39)

- Clarify the requirement for a school board adopted plan when school districts reallocate compensatory revenue. (p. 41)

FRE Undercounted

The report discussed the undercount of students eligible for Free and Reduced Lunch (FRE) when families do not fill out forms when eligible and the forms must be completed by October of the previous fall for revenue to be allocated in the current fiscal year.

- About 76 percent of superintendents in the OLA survey “believe there is an undercount.”

- The report made a general recommendation to improve this count issue, but made no specific recommendations.

Extended Time Activities

The report also addressed the requirement that 3.5 percent of new Compensatory Revenue be reserved for extended time activities and concluded that this requirement should be repealed for the following reasons.

Some school district officials said the reserved funding required them to add a new program that was problematic for their students who could not participate after school or during the summer.

Others said the amount reserved was too small to cover a new program, forcing them to use other funds to help pay for extended time programming.

Only 11 percent of school districts surveyed “agreed” or “strongly agreed” that reserving the money for this single purpose was the best use of funding for their district. (OLA Compensatory Revenue Report Executive Summary, 2020)

Taking Action

Immediately following the OLA Report, the committee heard HF3316 (Koegel) to repeal this set aside. MREA supports HF3316 and member district Lac Qui Parle Valley submitted a letter of support.

HF3316 passed unanimously out of committee and was placed on the general registrar for House Floor action.

Rural Need

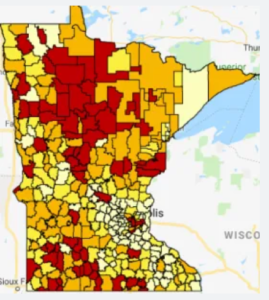

The reported noted that Compensatory funds are more widespread in Greater Minnesota than in the metro schools.

- 89% of Greater Minnesota school districts have more than 25% students eligible for Free or Reduced price meals

- Only 48% of metro districts meet that criteria

- Parts of rural Minnesota have the highest district-wide percentages

- The Twin Cities suburbs have among the lowest percentages

This can be seen in this MREA map of 18-19 percentage of students eligible for FRE, shown on the right. View interactive map.

Broadening the base of compensatory revenue to students eligible for FRE was one of MREA important legislative advances over the past 35 years.