Farmers in 266 Minnesota school districts are waiting for a special session to pass the tax bill (HF 848) pocket vetoed by Gov. Mark Dayton to receive an Ag2School 40 percent tax credit for school facility bonded debt on Ag Land starting in 2017. In 88 of those districts, the savings are projected to be $350 or more per $1 million in homestead agriculture land.

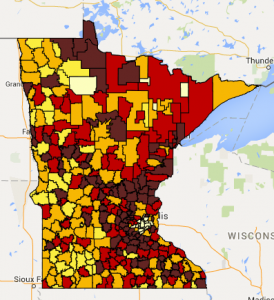

View the interactive map showing each district’s farmers’ projected annual savings starting in 2017. View the district by district listing with impact.

View the interactive map showing each district’s farmers’ projected annual savings starting in 2017. View the district by district listing with impact.

Tom Melcher, program finance director at the Minnesota Department of Education, provided MREA these details of the HF 848 Ag2School credit. This includes what bonded it covers and how schools will receive the funds to service their debt payments.

Who’s Eligible?

All class 2a, 2b, and 2c property (agricultural land, rural vacant land, managed forest land), under section 273.13, Subdivision 23 other than property consisting of the house, garage, and immediately surrounding one acre of land of an agricultural homestead.

What’s the credit amount?

The tax credit with equal 40 percent of the property’s eligible net tax capacity multiplied by the school general debt service tax rate (excludes OPEB Debt). View reduction estimates by district.

What is the process?

Here is the process for farmers to receive the tax credit:

- County auditor determines the tax reductions within the county and certifies the amounts to the Commissioner of Revenue as a part of the abstracts of tax lists.

- Commissioner of Revenue reviews for accuracy, and may make changes, or returns to the county auditor for correction.

- Commissioner of Revenue certifies the total tax reductions by school district to the Commissioner of Education, who makes the payments.

- The credit must be used to reduce the school district net tax capacity-based property tax levy.